Table Of Content

While our priority is editorial integrity, these pages may contain references to products from our partners. Lenders typically won’t let you refinance a mortgage loan until at least six months after you made your first monthly mortgage payment. You’ll also need to be current on your loan—that is, up to date on all your payments. Some lenders offer “no-cost” refinancing that helps borrowers reduce up-front refinancing fees.

Is it worth refinancing?

Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI).

How to refinance mortgage?

The resulting monthly mortgage payment doesn’t include the cost of Mortgage Insurance (MI), which may be required. Rate and Term Refinance—This method refinances the remaining balance for a lower interest rate and/or a more manageable loan term. Getting quotes from at least three mortgage lenders can help you maximize your savings when refinancing a mortgage.

Fixed rate vs adjustable rate

But remember not to borrow more than what your budget can comfortably handle. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum. It also lets you tap into the money you have in your home without replacing your entire mortgage, like you'd do with a cash-out refinance. If you don’t plan to stay for more than a couple of years, you should look closely at the lender’s loan estimates, which will show you the projected five-year cost. The main goal of most mortgage refinances is to lower your interest rate and maximize your savings.

If you can qualify for a better rate or would like to lower your payment by extending your repayment period, consider refinancing. Refinancing is ideal if you can reduce your rate by at least one percentage point and remain in your home long enough to recoup the closing costs. Pursuing a cash-out refinance is worth considering if you want to tap your home equity.

To estimate how much you could save each month with a refinance, first you’ll need to enter some information about your current mortgage. After that, you’ll add information about the new mortgage you’d like to apply for. I’ve covered the housing market, mortgages and real estate for the past 12 years. At Bankrate, my areas of focus include first-time homebuyers and mortgage rate trends, and I’m especially interested in the housing needs of baby boomers.

A mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments, the total costs of refinancing and how long it will take to recoup those costs. This can be circumvented by refinancing from an FHA loan to a conventional loan after 20% equity value is reached, since conventional loans do not require MIP payments after this point. In some cases, this will result in a less costly loan and a smaller monthly payment.

Mortgage calculator

Your refinance will eventually depend on the size of your property and how complicated your finances are. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. The total amount you have agreed to pay your mortgage company each month. If you are unsure of this amount, refer to a recent mortgage statement or call your mortgage company to find out.

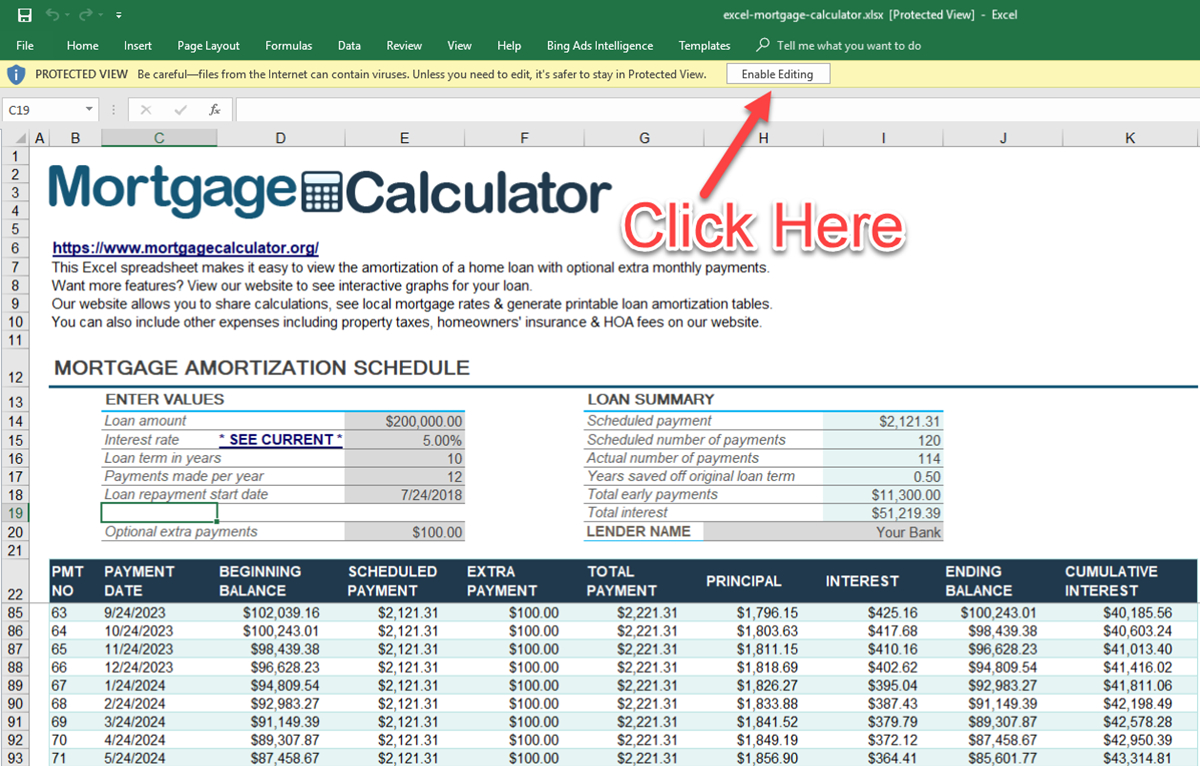

Before you apply for a mortgage refinance, check your credit score and get a copy of your credit report. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms. Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year.

Most experts say you’ll want to be in your house at least two to five years after refinancing, but you should do your own break-even calculation to figure out what makes the most sense for you. This will give you the numbers you need to fill in the first six fields in the calculator. The next section is a little trickier because it’s hard to know exactly how much closing costs will be until you’re well into the process of refinancing. Bankrate’s closing costs guide can give you an idea of which numbers to use here.

In specific situations, federal student loan debt can be completely forgiven, such as through the Teacher Student Loan Forgiveness program. When federal student loans are refinanced, they are no longer considered federal loans, but private loans, losing all the benefits of a federal loan. Mortgage refinancing is when you replace one home loan with another in order to access a lower interest rate, adjust the loan term or consolidate debt. Refinancing requires homeowners to complete a new loan application and may involve an appraisal and inspection of the home. Lenders also rely heavily on an applicant’s credit score and debt-to-income ratio when deciding whether to extend a new loan.

New Mexico Mortgage Calculator - The Motley Fool

New Mexico Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors. Much of the slider and the bars below it may be red in this scenario, indicating that you'll pay more total interest and closing fees during that period. We believe everyone should be able to make financial decisions with confidence. Explore the most common reasons you might consider refinancing your mortgage.

Loan term (years) - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest.

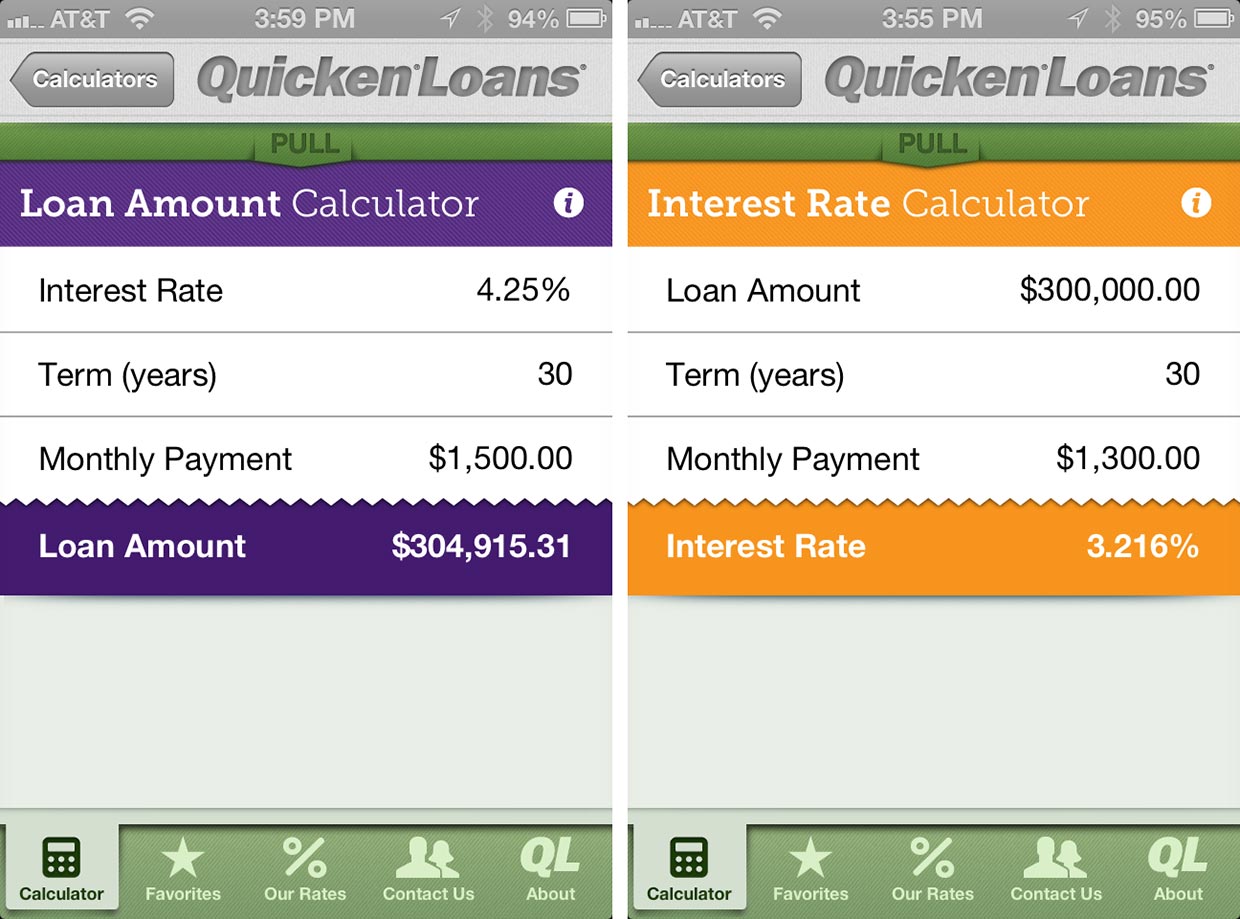

You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker. The information provided by you to Quicken Loans is not an application for a mortgage loan, nor is it used to pre-qualify you with any lender.

If you own your home through this date, you’ll have fully recouped the closing costs you paid when you refinanced. Your break-even point is when you can begin truly benefiting from the lower monthly payments that came with your refinance. Bankrate has helped people make smarter financial decisions for 40+ years. Our mortgage rate tables allow users to easily compare offers from trusted lenders and get personalized quotes in under 2 minutes.

No comments:

Post a Comment