Table Of Content

A balance transfer is a process of transferring high-interest debt from one or more credit cards to another card with a lower interest rate. The maximum amount of debt consolidated will depend on the new line of credit. Shorten the Loan—Borrowers can potentially pay off their existing loans faster by refinancing to shorter loan terms. One of the most common examples is refinancing a 30-year mortgage to a 15-year mortgage, which typically comes with a lower interest rate, though this will most likely result in a higher monthly payment.

How Much Does It Cost To Refinance A Mortgage?

Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. To find the best cash-out refinance lender for your needs, it’s important to shop around and compare your options from as many of them as possible, including your current mortgage lender. Consider not only interest rates but also repayment terms, any fees charged by the lender and eligibility requirements. Cash-out refinancing isn’t the only way to tap into your home equity. You could also consider a home equity line of credit (HELOC) or a home equity loan.

How To Use This Cash-Out Refinance Calculator

Cash-out refinancing can be a good option for homeowners looking to tap into their home equity. With this calculator, you can see what your monthly payment and overall cost would look like with a cash-out refinance. The major part of your mortgage payment is the principal and the interest.

Shop Around for the Best Rate

As you move the slider left and right, the calculator updates your total savings over the indicated number of years. The calculator includes interest paid, plus the estimated closing costs. If interest rates have dropped, or your credit score has improved, you may be able to get better home loan terms by refinancing. The total monthly payment includes mortgage principal, interest, taxes, insurance, and HOA fees, if applicable.

How much equity does a cash-out refinance require?

In the past, I’ve reported on market indicators like home sales and supply, as well as the real estate brokerage business. My work has been recognized by the National Association of Real Estate Editors. The time it takes to refinance a mortgage loan varies depending on the lender, the type of refinance loan and how prepared you are in advance.

How can refinancing lower my monthly mortgage payment?

Current Second Home Mortgage Rates - Business Insider

Current Second Home Mortgage Rates.

Posted: Tue, 23 Apr 2024 21:53:00 GMT [source]

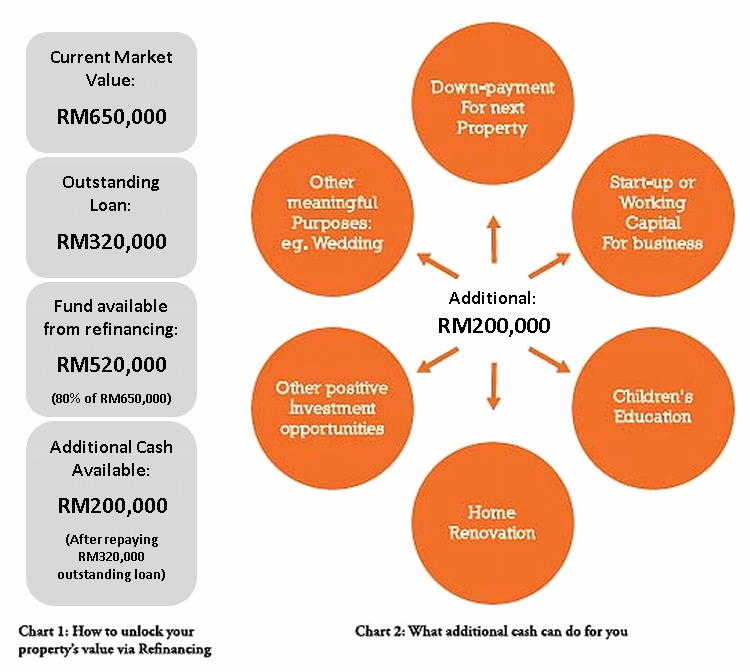

The application process to refinance a personal loan will take into account the borrower's credit history and score, as well as their debt-to-income ratio. For more information about or to do calculations involving personal loans, please visit the Personal Loan Calculator. If you have enough equity in your home, you may be able to do a cash-out refinance. With cash-out refinancing, you refinance your current home loan for more than the amount you currently owe and keep the extra money to spend on things like home projects or paying off other high-interest debt. In the "advanced settings" on the refinance calculator you can convert the tool to a cash-out refinance calculator. Most lenders allow you to roll the closing costs of the refinance into the balance of your new loan, increasing the total amount borrowed.

Apply with at least three lenders and obtain official Loan Estimates to compare loan costs and savings. Work with lenders to complete a cost-benefit analysis and determine whether refinancing makes sense for you. You’ll need to qualify for a refinance just as you needed to get approval for your original home loan. The higher your credit score, the better refinance rates lenders offer you — and the better your chances of underwriters approving your loan. For a conventional refinance, you’ll need a credit score of 620 or higher for approval.

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Virginia Mortgage Calculator - The Motley Fool

Virginia Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Forbes Advisor’s mortgage refinance calculator lets you estimate your new monthly mortgage payment using the terms of your current and refinanced loan. Based on that information, it also calculates how much you’ll save in monthly payments and interest over the life of the loan. You can use the calculator to total the costs of refinancing and how many months it will take to recover those costs (your break-even point).

Make sure you get everything in writing, such as fees and interest rates. Lenders will send you a loan estimate that breaks down your new loan details and all fees. Loan estimates are great tools for comparison shopping to give you the clearest picture of which lender will help you meet your refinance goals.

Keep in mind that like a cash-out refinance, a HELOC or home equity loan will be secured by your home, which means you risk foreclosure if you can’t make your payments. It’ll depend on the lender, but most require a credit score of at least 620 for a cash-out refinance. Also, remember that just like with any mortgage product, your home will be collateral for the cash-out refinance. This means you risk foreclosure if you don’t keep up with your payments. Loan start date - Select the month, day and year when your mortgage payments will start. Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area.

Currently, 30-year mortgage rates are above 7%, according to Zillow data. When you’re shopping around, be sure to ask about any discounts—including appraisal waivers—that might be available to you. Some financial institutions offer discounts to existing customers; you might also find military discounts. Finally, the lower your loan-to-value (LTV) ratio is, the lower your interest rate will be. If you don’t have to take cash out of your home when you refinance, you might want to avoid doing so as that will bump up your LTV and likely result in a higher interest rate.

No comments:

Post a Comment